BTC Price Prediction: $130K Breakout or $113K Retest?

#BTC

- Technical Crossroads: BTC tests upper Bollinger Band while MACD shows slowing bear momentum

- Institutional Momentum: Corporate treasury additions and hedge fund strategies driving demand

- Sentiment Divergence: Long-term holders taking profits as short-term traders enter

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Amidst Key Resistance Test

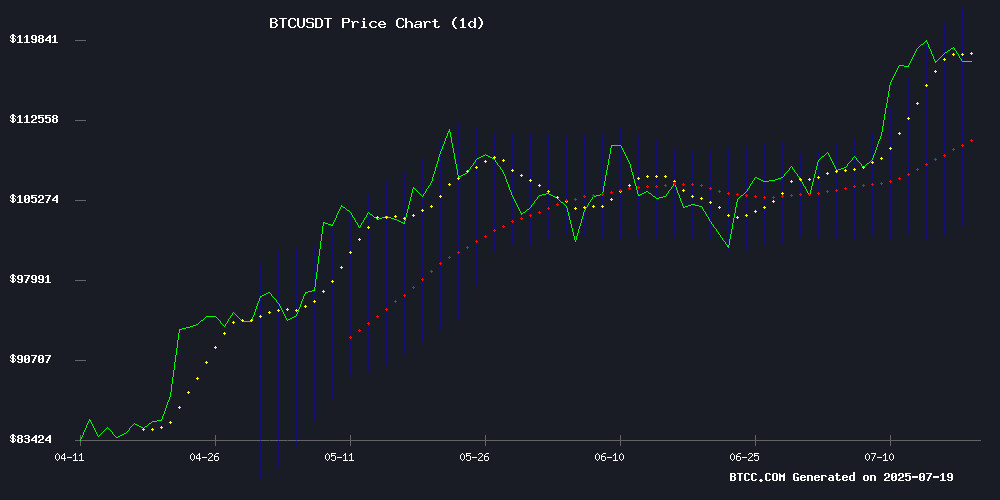

According to BTCC financial analyst James, Bitcoin (BTC) is currently trading at $118,029.80, showing strength above its 20-day moving average of $113,323.72. The MACD indicator remains negative but shows signs of convergence, suggesting potential momentum shift. Bollinger Bands indicate volatility with price testing the upper band at $123,267.88.James notes.

Market Sentiment: Institutional Adoption Grows Amid Rally Fatigue Signals

BTCC's James highlights conflicting signals:Notable developments include public companies adding BTC to treasuries ($72B safeguarded) and hedge funds achieving 640% returns through bitcoin strategies.James observes, noting altseason potential if BTC stabilizes above $120K.

Factors Influencing BTC’s Price

MicroStrategy's Bitcoin Bet Pays Off as MSTR Stock Surges 3,588%

MicroStrategy founder Michael Saylor has doubled down on his Bitcoin maximalist stance, declaring that "the only thing better than Bitcoin is more Bitcoin." The data supports his conviction: MSTR shares have skyrocketed 3,588% during what analysts call the "Bitcoin Standard era," dramatically outpacing BTC's 905% gain over the same period.

The corporate bitcoin playbook appears to deliver amplified returns. MicroStrategy's aggressive accumulation strategy—holding 214,400 BTC worth approximately $15 billion—has transformed the enterprise software company into a de facto Bitcoin ETF. Saylor's recent social media post highlights how aligning corporate strategy with Bitcoin adoption creates exponential value.

Bitcoin Long-Term Holders Shift to Selling as Short-Term Buyers Emerge, Signaling Potential Rally Fatigue

Bitcoin's relentless rally to a new all-time high of $123,218 on Binance has triggered a notable shift in investor behavior. On-chain data reveals long-term holders—those retaining BTC for over 155 days—have begun distributing assets, while short-term holders are accumulating aggressively. This divergence mirrors patterns observed before previous market pullbacks in April 2021 and November 2023.

Exchange inflows and funding rates now serve as critical watchpoints. A surge in BTC deposits to trading platforms like Binance could confirm mounting sell pressure, potentially derailing the current uptrend. The Spent Output Value Ranges indicator already shows heightened activity from whales moving 1,000-10,000 BTC batches to exchanges.

Bitcoin Faces Critical Test at $121K After Historic Pullback from $123K ATH

Bitcoin's rally to a historic all-time high of $123,000 in July has entered a consolidation phase, with the cryptocurrency now testing critical support at $121,000. The pullback, while minor, raises questions about whether this marks the beginning of a sustained bull market or a peak exhaustion signal.

Technical indicators present a mixed picture. Bitcoin remains above all key exponential moving averages (EMAs), and the Relative Strength Index (RSI) sits at healthy levels, suggesting a potential reset. The MACD, though showing some weakness, maintains bullish momentum. Market structure appears solid, but institutional positioning uncertainty lingers.

Fundamental developments add complexity to the technical picture. Charles Schwab's recent entry into Bitcoin trading and the so-called 'Genius Act'—which opens retirement markets to crypto investments—could provide fresh institutional inflows. Trading volume remains robust as the market digests these developments.

Bitcoin Traders Alert: SOPR Indicator Signals Potential 20% Pullback

Bitcoin's 90-day Spent Output Profit Ratio (SOPR) has climbed to 1.018, nearing the critical 1.02 threshold that historically precedes sharp corrections. Previous instances in March 2024 and February 2025 saw 10-20% price declines within two weeks of crossing this level. The metric reflects mounting profit-taking pressure as BTC hovers NEAR $66,000.

Parallel declines in Network Value to Transactions (NVT) and Network Value to Metcalfe (NVM) ratios—down 11.21% and 16.21% respectively—suggest price appreciation may be outpacing fundamental adoption metrics. This divergence raises questions about sustainability despite bullish ETF inflows and macroeconomic tailwinds.

Market structure shows contradictory signals: perpetual swap funding rates remain moderate while exchange reserves continue declining, indicating Leveraged longs haven't yet reached extreme levels. The coming days will test whether institutional demand can absorb potential sell-side volatility.

Bitcoin Hitting $120K Signals Impending Altseason as Metrics Show Capital Rotation

Bitcoin's sustained rally above $120,000 appears to be triggering a market rotation into altcoins, with three key metrics suggesting the crypto market may be on the cusp of a new altseason. The Altcoin Index has surged 300% to 50 from 15 in under a month, historically a reliable indicator of altcoin outperformance when crossing the 50 threshold.

Bitcoin's dominance has simultaneously retreated below 58% from recent highs of 62%, signaling growing investor appetite for riskier assets beyond the market leader. This capital rotation mirrors previous cycle patterns where extended BTC rallies eventually give way to broad altcoin runs.

The metrics paint a picture of diversifying portfolios, with traders allocating to smaller-cap projects as confidence in the broader market grows. Such shifts often precede periods where altcoins significantly outperform Bitcoin, though the transition historically occurs in waves rather than abrupt switches.

IMF Exposes El Salvador's False Bitcoin Accumulation Claims

El Salvador's government has been misleading the public about its Bitcoin purchases throughout 2025, according to a damning IMF report. Despite President Nayib Bukele's social media claims of daily BTC accumulation, the IMF confirmed zero new acquisitions since December 2024's $1.4 billion bailout approval.

The revelation exposes a carefully orchestrated deception—while public wallets showed growing balances, the government was merely consolidating existing holdings across multiple addresses. This subterfuge occurred alongside Bukele's March 4 declaration that daily buying remained active, with officials touting holdings exceeding 6,102 BTC.

Footnote #9 of the IMF's Article IV consultation reveals the truth: El Salvador halted purchases as a loan condition, then engineered the illusion of continued accumulation. The episode raises serious questions about transparency in national cryptocurrency adoption strategies.

Mint Miner's Cloud Mining Platform Generates $37,500 Daily for 5 Million Users Amid Bitcoin Volatility

As Bitcoin surged to a record $123,000 during Crypto Week 2025, investors flocked to low-risk alternatives like Mint Miner's cloud mining platform. The London-based company, operating 108 green data centers globally, now serves 5 million users across 180 countries with its compliant, AI-driven mining infrastructure.

Market turbulence following Bitcoin's rally has heightened demand for stable passive income streams. Mint Miner's renewable energy partnerships and multi-jurisdictional licensing position it as a leader in sustainable crypto infrastructure. The platform's daily $37,500 payout demonstrates institutional-grade scalability in decentralized finance.

Bitcoin Giant Strategy Safeguards $72 Billion BTC Holdings with Secretive Custody Approach

Strategy, the institutional Bitcoin holder with a $72 billion stash, has implemented a highly secretive custody strategy. The firm has distributed its holdings across multiple undisclosed institutional custodians, with Coinbase confirmed as one provider and Fidelity speculated to be another.

Coinbase CEO Brian Armstrong recently revealed on X that his platform secures Bitcoin for eight of the top ten public companies holding BTC. This disclosure strongly implicates Coinbase in Strategy's custody arrangements. Armstrong noted Coinbase Prime holds 81% of all crypto assets in US ETFs - approximately $140 billion.

The Bitcoin behemoth maintains strict confidentiality about its custody partners, referring only to "various custody" setups with NYDFS-regulated, U.S.-based institutions that meet rigorous security and compliance standards. This opaque approach reflects growing institutional adoption patterns where security concerns outweigh transparency demands.

BTC AB Adds Bitcoin to Treasury and Secures Frankfurt Listing

BTC AB is making bold moves in the cryptocurrency space, diverging from the cautious approach of most corporations. The company has converted fiat capital into digital assets, reinforcing its position in global capital markets.

Its recent listing on the Frankfurt Stock Exchange marks a significant milestone, providing institutional investors with regulated access to Bitcoin exposure. This strategic pivot underscores growing institutional confidence in crypto as a treasury asset.

Hedge Fund 210k Capital Sees 640% Return via Bitcoin Proxy Strategy

David Bailey's 210k Capital has delivered a 640% net return over the past year by transforming small-cap public companies into Bitcoin proxies. The hedge fund's strategy involves convincing these firms to allocate treasury reserves to BTC, capitalizing on the cryptocurrency's appreciation. With $433 million in assets under management, 210k has turned niche investments into windfalls—like its £780,000 stake in UK web firm Smarter Web now worth £110 million after the company amassed 1,600 BTC.

The approach isn't without volatility. Smarter Web's shares have plunged 55% from June highs, underscoring how these proxy plays remain tethered to crypto market sentiment. Yet successes like Japan's Metaplanet—which pivoted from hotels to Bitcoin holding—demonstrate the model's potential. The fund's gains align with a broader crypto rally fueled by pro-industry political tailwinds.

Public Companies Accelerate Bitcoin Adoption as Institutional Holdings Surge

Bitcoin's ascent to mainstream financial acceptance reached a new milestone as 125 publicly traded companies now hold significant BTC positions. Corporate treasuries increasingly treat the cryptocurrency as a strategic asset rather than speculative gamble, with Bitwise data revealing unprecedented institutional accumulation.

The shift mirrors growing recognition of Bitcoin's inflation-hedging properties amid global monetary expansion. Brian Harrod's analysis highlights how blue-chip firms are rewriting corporate treasury strategies, with BTC allocations becoming table stakes in modern portfolio management.

How High Will BTC Price Go?

James projects two scenarios for BTC:

| Scenario | Trigger | Price Target | Timeframe |

|---|---|---|---|

| Bullish | Daily close above $123K | $130K-$135K | 2-3 weeks |

| Neutral | Hold $113K support | $118K-$123K | Consolidation |

| Bearish | SOPR correction | 20% pullback ($94K) | Risk if $113K breaks |

Key drivers: 1) Institutional inflows (MicroStrategy, BTC AB), 2) Miner selling pressure, 3) Altseason rotation timing.

$118,029.80

$113,323.72

$123,267.88

Converging bearish